The latest Chinese Consumer Price Index (CPI) data revealed a 0.6% rise in August, slightly below market expectations. This was an increase from the previous month’s growth of 0.5%. On the other hand, Chinese Producer Price Index (PPI) declined by 1.8% year-on-year, falling short of the market forecast. This data can have a significant impact on the Australian Dollar (AUD) due to the close economic relationship between China and Australia.

There are several key factors that influence the value of the Australian Dollar. One of the primary drivers is the level of interest rates set by the Reserve Bank of Australia (RBA). The RBA’s decisions on interest rates can affect the overall economy and subsequently impact the value of the AUD. Additionally, the price of Iron Ore, Australia’s largest export, plays a crucial role in determining the strength of the Australian Dollar.

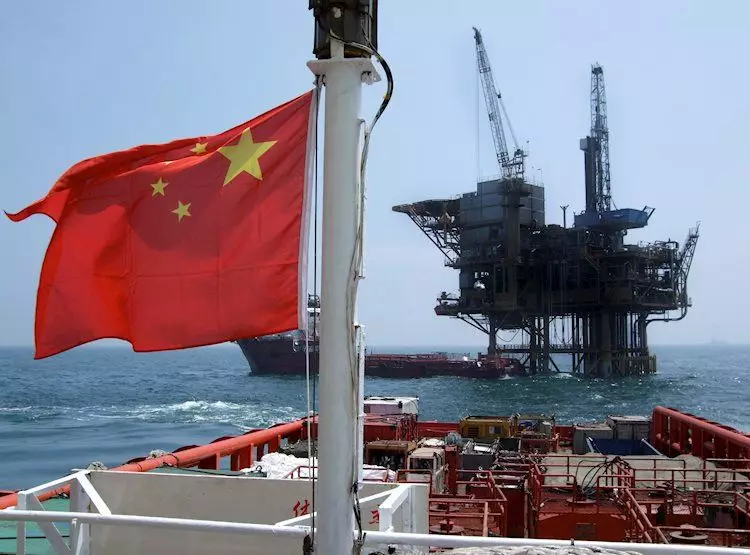

As China is Australia’s largest trading partner, the health of the Chinese economy directly impacts the value of the Australian Dollar. When the Chinese economy performs well, it leads to an increase in demand for Australian exports, thereby boosting the AUD. Conversely, any slowdown in the Chinese economy can have adverse effects on the Australian Dollar.

The Trade Balance of a country, which reflects the difference between exports and imports, also plays a role in determining the value of its currency. Australia’s positive Trade Balance, driven by exports such as Iron Ore, can strengthen the Australian Dollar. The price of Iron Ore, in particular, is a critical factor as it directly affects the demand for the AUD.

Apart from economic indicators, market sentiment also influences the value of the Australian Dollar. Investor behavior, whether risk-on or risk-off, can impact the AUD movement. Additionally, the RBA’s policies, such as interest rate adjustments and quantitative easing, play a crucial role in shaping the value of the Australian Dollar in the foreign exchange market.

The Australian Dollar is influenced by various domestic and international factors, with Chinese economic data playing a significant role. Traders and investors closely monitor developments in China, particularly inflation and economic growth data, to gauge the potential impact on the AUD. Understanding these dynamics is essential for anyone looking to trade or invest in the Australian Dollar and navigate the ever-changing foreign exchange market.