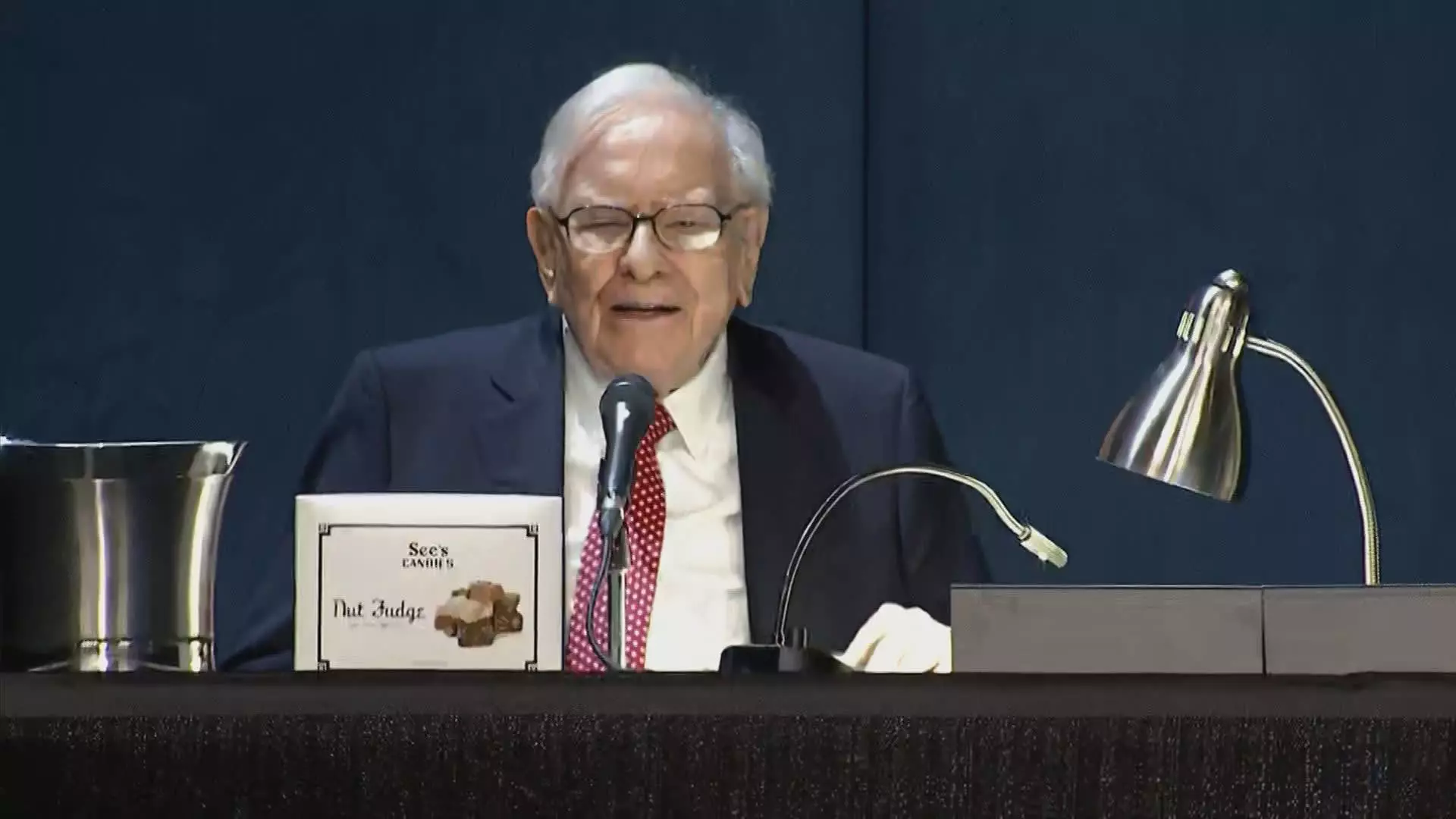

Warren Buffett’s Berkshire Hathaway has been on a selling spree, offloading a significant portion of its Bank of America shares. The conglomerate has sold more than $7 billion worth of BofA shares since mid-July, reducing its stake to 11%. In a recent regulatory filing, it was revealed that Berkshire sold 5.8 million BofA shares in separate sales, totaling almost $228.7 million.

The recent sales marked Berkshire’s 12th consecutive selling session, matching a similar streak in July and August. With over 174.7 million shares of BofA sold, Berkshire now holds 858.2 million shares, representing 11.1% of shares outstanding. This has pushed BofA down to the No.3 spot on Berkshire’s list of top holdings, behind Apple and American Express.

Warren Buffett’s relationship with Bank of America dates back to 2011 when he bought $5 billion worth of BofA’s preferred stock and warrants in the aftermath of the financial crisis. By converting those warrants in 2017, Berkshire became the largest shareholder in BofA. Buffett later added 300 million more shares to his bet in 2018 and 2019.

BofA CEO Brian Moynihan responded to Berkshire’s sales by stating that he has no knowledge of Buffett’s motivation for selling. Despite the sales, Moynihan praised Buffett’s investment in BofA in 2011, which helped stabilize the bank during a challenging time. BofA shares have dipped only about 1% since July and are up 16.7% this year, outperforming the S&P 500.

Warren Buffett’s Berkshire Hathaway’s decision to sell a large chunk of Bank of America shares has raised questions about the billionaire’s investment strategy. While the exact reasons for the sales are unclear, Berkshire’s actions have significantly reduced its stake in BofA. It remains to be seen how the market will react to Berkshire’s ongoing selling streak and what implications it may have for both Berkshire and Bank of America.