In a bold move that underscores growing tensions between financial technology firms and social media giants, Revolut has issued a strong critique of Meta’s efforts to mitigate fraud on its platforms. The British fintech company has challenged Meta’s approach, stating that the measures currently in place are insufficient to protect users from becoming victims of online scams. This criticism arises in response to a recent partnership between Meta, NatWest, and Metro Bank aimed at enhancing data-sharing to combat fraud. Revolut firmly believes that mere data sharing isn’t enough; rather, a more comprehensive approach involving financial restitution for victims is necessary.

The Implications of Meta’s Limited Response

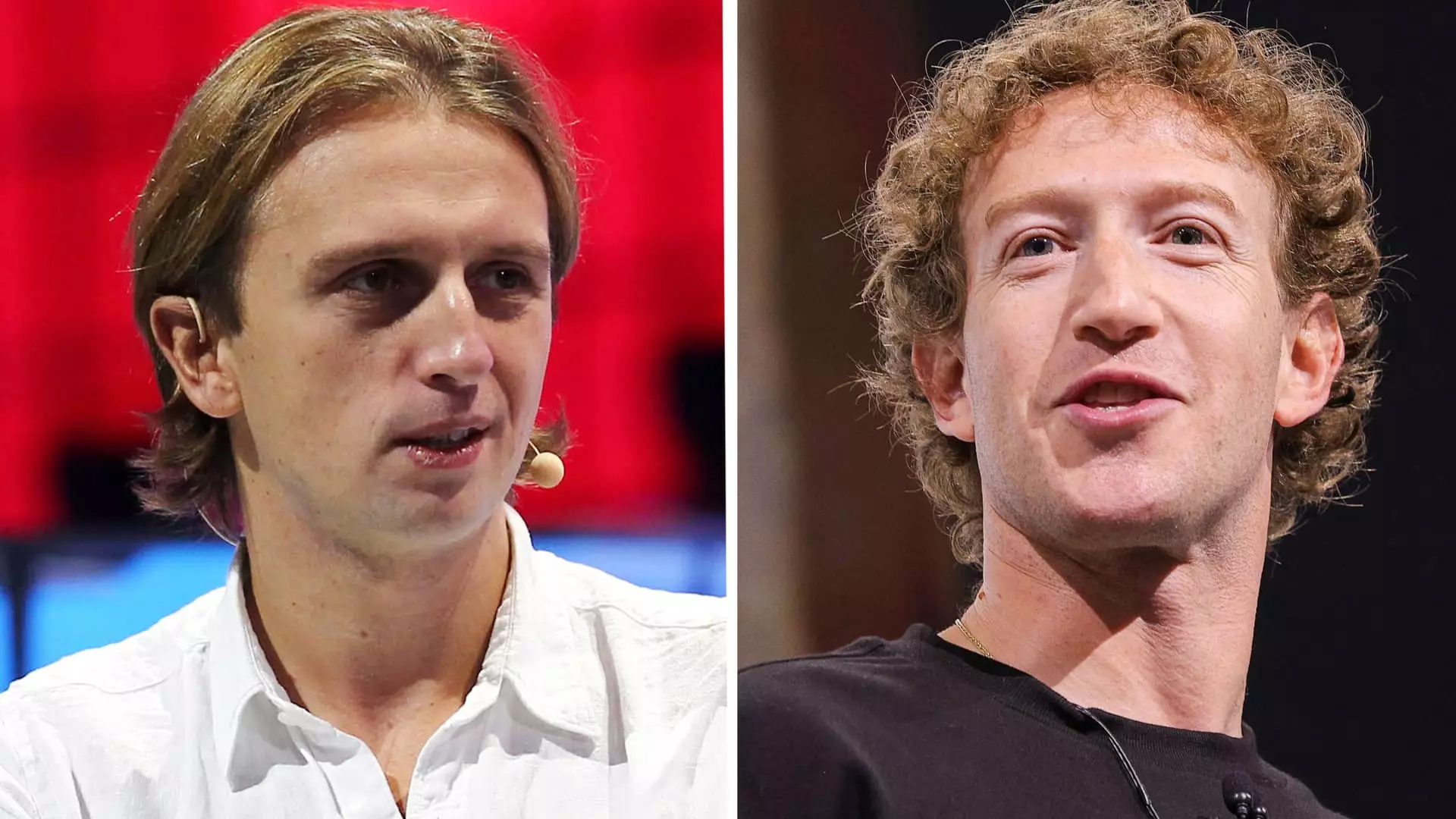

Woody Malouf, Revolut’s head of financial crime, articulated a pressing concern: the lack of accountability among social media platforms like Meta in reimbursing users who fall prey to fraud. According to Revolut’s perspective, Meta’s initiatives represent minimal progress—a few “baby steps” when what the industry truly necessitates are “giant leaps forward.” This stark comparison highlights the increasing frustration felt by financial institutions towards social media platforms that continue to operate with seemingly little accountability regarding fraud-related issues.

Malouf argues that without a financial incentive to actively tackle fraud, platforms like Meta will remain lethargic in their efforts to protect consumers. The crux of the argument lies in the assertion that unless these platforms are held responsible for the financial fallout experienced by scam victims, they will not prioritize effective solutions.

Regulatory changes aimed at combatting financial fraud in the UK are set to come into effect soon, yet Revolut highlights that these measures alone will not suffice without active participation from entities like Meta. Starting October 7, new regulations will mandate banks and payment firms to provide limited compensation for victims of authorized push payment fraud, with a cap of £85,000. However, prior recommendations suggested significantly higher compensation limits which were curtailed following pushback from banking institutions.

Revolut’s advocacy extends beyond dissatisfaction with Meta; the company finds itself navigating a complex regulatory landscape while simultaneously urging social media companies to share the burden of responsibility. This call to action emphasizes the need for a cooperative framework to ensure that victims receive both protection and financial redress.

To effectively combat online fraud, financial technology companies and social media platforms must collaboratively redefine their roles and responsibilities. Revolut’s insistence on accountability serves as a crucial reminder that fraud isn’t solely a financial issue; it’s a complex problem that requires the involvement of every stakeholder in the digital ecosystem.

In essence, Revolut’s response to Meta is emblematic of a larger conversation regarding responsibility in the digital age. As scams continue to evolve and proliferate, both technology firms and regulatory bodies must engage in a dialogue that promotes stronger protections for consumers while ensuring that platforms are held accountable for the environments they create. Only through a united front can significant strides be made against the regrettable rise of online fraud.