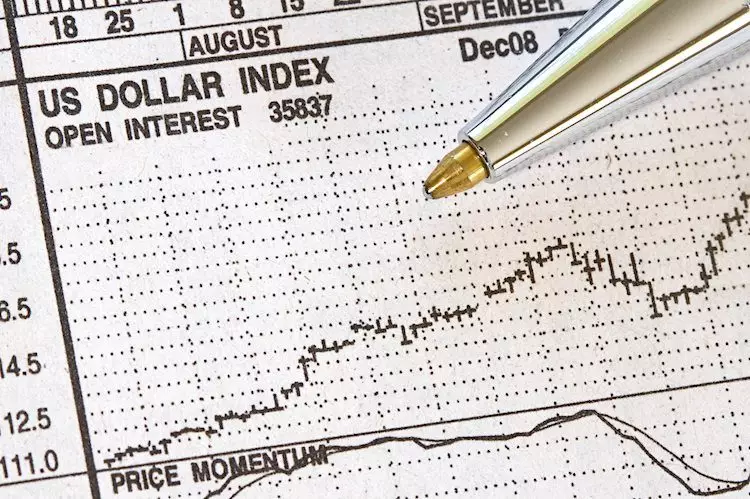

In recent weeks, the US Dollar has experienced fluctuations reflective of broader economic trends. Following a substantial climb, it appears that the Dollar’s ascent may be stalling as traders react to new measures implemented by China to stimulate its economy. Amid these dynamics, the US Dollar Index, which is a key indicator of the currency’s strength against a basket of others, seems to be facing a momentary slowdown projected around the 104.00 benchmark. This pause prompts speculation regarding the currency’s future direction, particularly as significant economic data releases loom on the horizon.

The US Census Bureau is set to publish vital housing statistics for September at 12:30 GMT, which will include anticipated figures for Building Permits and Housing Starts. The expected minor dip in these numbers from August suggests a potentially cooling housing market, which in turn could weigh on economic growth narratives. Market observers are keen to determine if these fundamentals will have an appreciable impact on the Dollar in the coming trading sessions.

The day’s events do not end with the housing data; prominent figures from the Federal Reserve are scheduled to deliver speeches and participate in discussions. At 13:30 GMT, Atlanta Fed President Raphael Bostic will engage with high school students, emphasizing economic education. However, it’s his later remarks at the Mississippi Council on Economic Education’s luncheon that hold safeguarding implications for the Dollar. Investors will be scrutinizing his comments for insights on the Fed’s monetary policy and its response to the evolving economic landscape.

Similarly, the activities of his colleagues, like Minneapolis Fed President Neel Kashkari and Federal Reserve Governor Christopher Waller, will likely shed light on the central bank’s future maneuvers. Their discussions will inevitably intertwine with the prevailing sentiment of the markets, especially given the persistent uncertainty surrounding interest rate trajectories.

Recent signals indicate that the market is pricing in a nearly certain rate cut during the Fed’s November 7 meeting. With about a 90% probability of a 25 basis points reduction, many analysts are reevaluating their expectations for the US economic outlook. This sentiment is reflected in the movement of the 10-year benchmark rate, which has hovered around 4.11%, echoing concerns regarding the Fed’s ability to combat inflation without jeopardizing the stability of the banking sector.

This tumultuous backdrop is compounded by recent Chinese economic data, which has offered positive surprises that bolster domestic demand and investor confidence. Any robust economic growth from China tends to offer a counterbalance to the Dollar’s strength due to the interconnectedness of global markets. As traders adjust to these new realities, the question remains whether the Dollar can maintain its position of power against strengthening foreign currencies, particularly if Chinese stimulus measures continue to yield favorable economic results.

One cannot discuss the Dollar’s performance without acknowledging the ramifications of the banking crisis that erupted in March 2023. The collapse of notable banks like Silicon Valley Bank (SVB) — triggered by the fallout from heightened interest rates and a rush of withdrawal requests — reshaped market expectations for interest rates. As liquidity issues surfaced, investor sentiment turned sharply bearish regarding future Fed policy.

The crisis caused a paradigm shift: rather than signaling potential further rate hikes to control inflation, the Fed appeared poised to adopt a more cautious approach, thus amplifying Dollar weakness. Consequently, as history has shown, financial instability tends to bolster safe-haven assets like gold, casting a shadow over the Greenback. With expectations of a Fed pivot becoming reality, the equilibrium of the currency market has been altered significantly.

Despite the turbulence faced by the Dollar, technical indicators suggest that it may remain buoyed within certain parameters. Resistance levels around the 103.80 mark, coupled with the influential 200-day Simple Moving Average (SMA), indicate potential areas of significant interest for traders. Conversely, should the Dollar falter, the 100-day SMA around 103.19 serves as a crucial support threshold, reflecting the intricacies of investor sentiment and market dynamics.

As the political landscape evolves with looming elections, particularly with potential candidates like Trump gaining traction in the polls, the notion that Dollar volatility might ensue accompanies these shifts. Should political sentiments cause a rapid swing in investor confidence, we may witness the Dollar move toward levels like 105.00, reaffirming the intricate dance of economic indicators and influence.

The current state of the US Dollar embodies a complex interplay of domestic and international factors that continue to shape its trajectory. Addressing these nuances is vital for any market participant seeking to navigate this ever-evolving economic landscape effectively.