In the world of finance, few elements are as influential as geopolitical developments and economic data. Recently, global markets experienced a whirlwind of changes spurred by escalating tensions, particularly between nuclear powers like the United States and Russia. However, as the situation evolved, some calm returned, allowing Asian markets to prepare for important economic announcements. Investors are keeping a watchful eye on corporate earnings and monetary policies, which could play a pivotal role in defining the immediate market trajectory.

The recent tensions arising from the Ukraine conflict have cast a long shadow over global markets, affecting investor sentiment and leading to unprecedented volatility. After a particularly concerning announcement from U.S. officials regarding the use of American-made weapons by Ukraine against Russia, fears of potential nuclear escalation emerged. This caused an abrupt downturn in stock prices, accompanied by a surge in the volatility index (VIX), a measure of anticipated fluctuations in the U.S. equity markets.

Market participants were momentarily shaken. Notably, the S&P 500 and Nasdaq experienced notable dips, with the VIX climbing to levels not seen since nearly a year ago. However, as the day progressed, resilience was apparent. Both indices ended the trading session in positive territory, suggesting that investor anxiety can sometimes dissipate, at least temporarily. As markets opened in Asia, this sense of cautious optimism lingered, even amid the geopolitical backdrop.

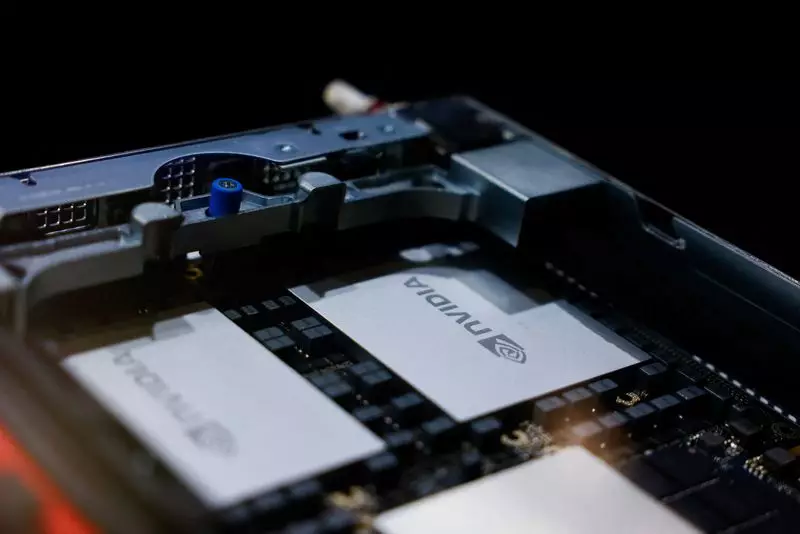

Amidst this geopolitical uncertainty, attention in Asia is sharply focused on corporate earnings reports, specifically that of Nvidia, a heavyweight in the semiconductor industry. This upcoming announcement is highly anticipated, not only because of Nvidia’s key role in technology but also due to its significance as a bellwether for the sector’s health. Analysts predict a staggering 82.8% surge in revenue, projecting figures that could reach approximately $33.125 billion for the August-October quarter. Such growth could reflect broader trends in demand for technology and semiconductors, given Nvidia’s centrality in powering modern computing solutions.

The results from Nvidia could set the tone for market performance in Asia as investors look to gauge the strength of global demand, particularly in light of the tech sector’s susceptibility to international changes and competition. Therefore, the upcoming earnings announcement transcends its corporate implications, reflecting shifts within the global economic framework.

While corporate earnings are vital, economic indicators also play a crucial role in maintaining stable market conditions. In Asia, several key data points are due for release. South Korea’s producer price inflation and Japan and Taiwan’s trade figures will be pivotal in understanding regional economic performance. Taiwan’s trade data is of particular interest, as its export activities are often seen as a barometer for global demand, especially with major shipments coming from TSMC, a leading semiconductor maker. This underscores the interconnectedness of economies in the region and how local performance can impact global trends.

Furthermore, on the monetary policy front, the decisions from the People’s Bank of China and Bank Indonesia will have significant implications for exchange rates and liquidity. Both central banks are widely expected to maintain their current interest rates, balancing the need for economic stability with the growing pressures from external factors, including potential trade policy adjustments from the U.S. following the upcoming election.

As we look ahead, the interplay between geopolitical tensions and economic data presents both challenges and opportunities. The ability of Asian markets to adapt to a rapidly changing global context will be essential for sustaining growth and investor confidence. By focusing on critical earnings reports, reacting to economic indicators, and understanding underlying geopolitical dynamics, investors can navigate this complex landscape more effectively. The coming days will be instrumental in shaping market perceptions and strategies as we observe how these multifaceted factors evolve.