As 2023 draws to a close, the Asian markets exhibited a slight uptick, albeit within a context of holiday-thinned trading. Trading activity diminished considerably, especially with major markets such as Hong Kong, Australia, and New Zealand observing closures for public holidays. Despite the reduced activity, investors remained focused on the anticipated shifts in monetary policy from the U.S. Federal Reserve. Amid limited news and economic data, market dynamics were largely influenced by sentiments stemming from the U.S. Federal Reserve’s recent announcements regarding interest rates.

The Federal Reserve’s policy directions serve as a critical compass for contemporary market trends, particularly in light of Jerome Powell’s address during the central bank’s last meeting of the year. Powell’s comments suggested a tempering of expectations concerning rate cuts in 2025, indicating that traders are currently hedging their bets on only about 35 basis points of easing. This cautious outlook has had a direct bearing on both U.S. Treasury yields and the strength of the U.S. dollar, which has been characterized by a significant rise, hitting levels that have not been seen for nearly two years.

The benchmark 10-year Treasury yield has shown an impressive climb, previously breaching the 4.6% threshold, marking it as its highest since late May. Such movements in yields carry broad implications, particularly affecting the commodities market and typically safe-haven assets like gold, which tend to react negatively to a strong dollar. Analysts are now speculating whether the Fed will pause its rate adjustments in January, awaiting further economic indicators before making a definitive decision on its monetary policy trajectory.

Trading data reveals that the U.S. dollar has been gaining substantial ground against a basket of currencies, hovering near a two-year peak at 108.15. This strengthening dollar is becoming a significant challenge for other currencies. For instance, both the Australian and New Zealand dollars faced notable declines, reflecting broader market adjustments as traders responded to the dollar’s strength. The Australian dollar fell to approximately $0.6241, whereas the New Zealand dollar saw a dip to around $0.5650.

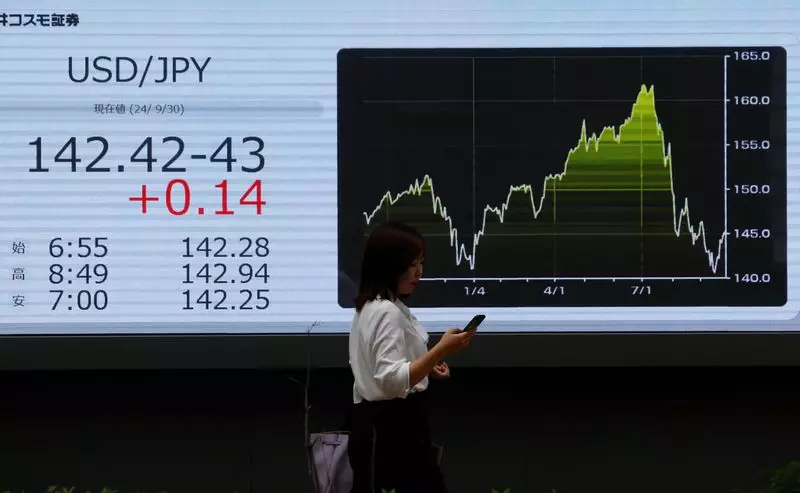

In this climate, even traditional stalwarts like the euro and Japanese yen are feeling the pressure, with the euro weakening against the dollar and the yen approaching a five-month low. The economic challenges in Japan have only exacerbated this trend, with the government gearing up for an unprecedented $735 billion budget, primarily to manage escalating social security and debt-servicing obligations.

Despite the intermittent fluctuations observed in the markets, the Asian equities index, as measured by the MSCI, showed signs of resilience with a modest increase of 0.04%. This uptick is significant, especially when placed in the context of a broader narrative of market performance throughout the year, where global equities have thrived, supported by a bullish trajectory for U.S. stocks.

The optimism surrounding U.S. equities has been fueled predominantly by advancements in artificial intelligence and robust economic output, drawing a considerable influx of capital into the American financial markets. This has raised assertions among analysts regarding an overarching sense of exuberance in market sentiment, with some indicating that this excitement has not significantly disrupted investments in other regions.

Japan’s market also holds supportive trends, with the Nikkei index on track for an impressive yearly gain surpassing 17%. Conversely, China’s stock indices have seen slight declines but are still expected to finish the year positively, thanks largely to government efforts aimed at revitalizing its struggling economy.

The cryptocurrency market shows intriguing activity, particularly with Bitcoin trading higher at around $98,967, despite experiencing volatility and having recently dipped from its peak above $100,000. Notably, external factors like U.S. monetary policy shifts have contributed to this turbulence. In a move reflecting the evolution of the cryptocurrency landscape, Russian firms have begun integrating Bitcoin into international transactions as a countermeasure against Western economic sanctions, thus broadening the use of digital currencies on the global stage.

In the realm of commodities, modest increases in oil prices were noted, with Brent crude oil and U.S. crude achieving slight gains. Meanwhile, gold prices edged up as investors sought refuge amidst broader economic shifts, showcasing the typical reactions seen in commodity markets against the backdrop of currency fluctuations.

As the year comes to a close, both the Asian and global markets reflect a complex interplay of factors, including the monetary policy stances from the Federal Reserve, the strength of the dollar, and shifting dynamics across various sectors including cryptocurrencies. The coming year holds promise for further developments as economic indicators continue to dictate market movements, shaping the outlook for investors navigating this evolving landscape.