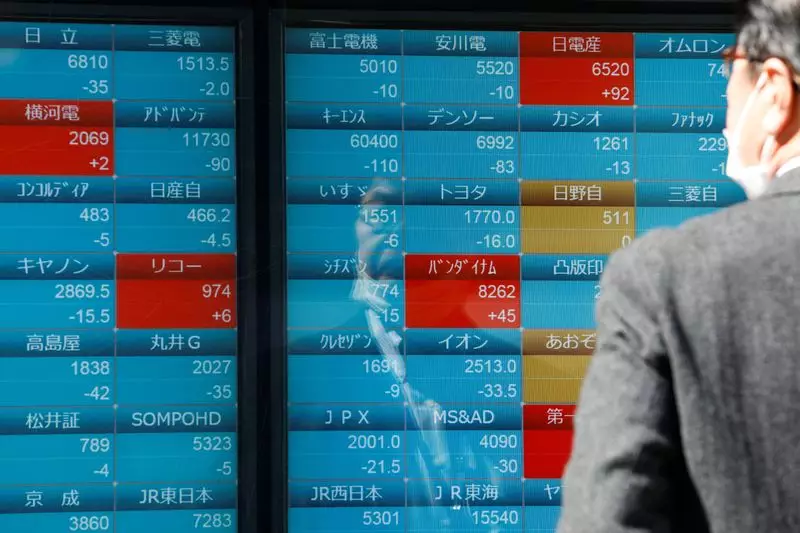

The Asian share benchmarks experienced a decline on Thursday as investors grappled with the implications of policymakers in major economies adopting a patient approach to monetary easing amidst persistent inflation concerns. The MSCI’s broadest index of Asia-Pacific shares outside Japan registered a decrease of 0.57%, reflecting a cautious sentiment among traders. This sentiment was further exacerbated by geopolitical tensions, including China’s military undertaking drills around Taiwan, following the inauguration of Taiwan’s new President Lai Ching-te. However, the response from Taiwan’s stock market appeared more resilient, with a modest gain of 0.3%.

The recent release of the Federal Reserve’s hawkish minutes, coupled with a surge in UK inflation and a bleak assessment of New Zealand’s inflationary challenges, have created a sense of apprehension among investors. The ambiguity surrounding central bank policies, particularly regarding interest rates and inflation management, has contributed to market uncertainties. Kyle Rodda, a senior financial market analyst at Capital.com, highlighted the prevailing doubts regarding policy frameworks and their impact on market dynamics. This prevailing uncertainty has prompted investors to reevaluate their expectations of global rate cuts in the near future.

Amidst the market turbulence, the tech sector witnessed a positive development with Nvidia forecasting quarterly revenue that exceeded estimates. This announcement led to a surge in Nvidia’s shares by 5.9% during extended trading hours, signaling optimism in the market. U.S. futures, including S&P 500 and Nasdaq, also recorded gains in Asian trade, showcasing resilience in the face of prevailing uncertainties. In contrast, markets in Hong Kong and China experienced profit-taking, resulting in declines in the Hang Seng Index and the blue-chip index, respectively.

The fluctuations in commodity prices further underscored the impact of economic uncertainties on the market. Gold prices dipped by 0.25% as the possibility of prolonged higher U.S. interest rates diminished the appeal of the precious metal. Similarly, oil prices experienced a downturn, with brent crude and U.S. crude decreasing by 0.82% and 0.9% respectively. On the currency front, the British pound and the New Zealand dollar maintained near two-month highs, reflecting a nuanced response to the prevailing economic conditions.

The policy uncertainties emanating from major central banks have cast a shadow over Asian markets, leading to heightened volatility and cautious investor behavior. The interplay between geopolitical tensions, company earnings, and commodity prices has further contributed to the complex landscape facing investors. As market participants navigate these challenges, a prudent approach to risk management and a keen awareness of global economic trends will be essential in fostering resilience and adaptability in the face of uncertainty.