Warren Buffett, also known as the “Oracle of Omaha,” has raised eyebrows among his followers by owning the exact same number of shares in Apple as he does in Coca-Cola. This peculiar observation came to light after a regulatory filing revealed Berkshire Hathaway’s equity holdings at the end of the second quarter: both Apple and Coca-Cola stand at a share count of 400 million. Despite cutting his tech holdings in Apple by half, some speculate that Buffett’s affinity for round numbers may mean he has no intention of selling any more Apple shares.

The Longstanding Stake in Coca-Cola

Buffett’s long and steady relationship with Coca-Cola dates back to 1988 when he first acquired 14,172,500 shares. Over the years, he increased his stake in the company to 100 million shares by 1994 and kept it consistent at this rounded figure for three decades. Through stock splits in 2006 and 2012, Berkshire’s Coca-Cola holding grew to 400 million shares. This enduring investment in Coca-Cola parallels his childhood fondness for the iconic soft drink, which he discovered at the age of six. His early entrepreneurial ventures with selling Cokes highlighted the consumer appeal and commercial potential of the product.

While Buffett’s investment philosophy aligns more with value investing, his foray into tech giants like Apple appears to deviate from this strategy. However, he views Apple as a consumer products company akin to Coca-Cola rather than purely a technology play. Buffett praises the loyal following of the iPhone, stating that people value their smartphones even more than their cars. In fact, he considers Apple the second most significant business in Berkshire’s portfolio, after its insurance companies. Despite this, Berkshire significantly reduced its Apple stake by over 49% in the second quarter, causing a shift in its portfolio weighting from nearly 50% to about 30%.

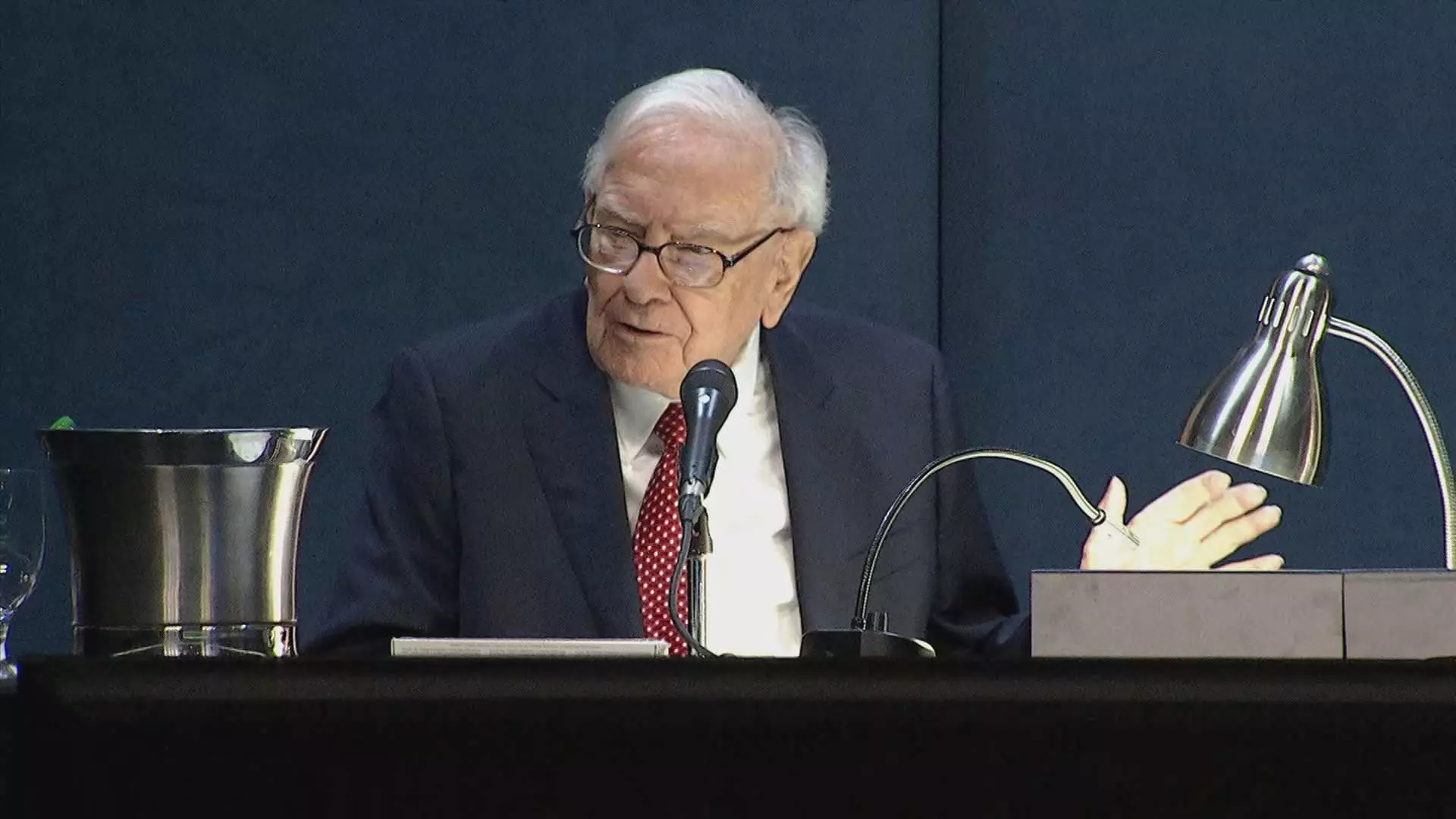

The divestment of Apple shares and the subsequent symmetry with the Coca-Cola position has led to speculation about Buffett’s strategic intentions. While some argue that it may be a mere coincidence, others believe it aligns with Buffett’s preference for round numbers and long-term holdings. At Berkshire’s annual meeting, Buffett emphasized the everlasting nature of investments in both Coca-Cola and Apple, indicating a deliberate approach to these holdings. Ultimately, whether Buffett’s ownership of Apple and Coca-Cola is a stroke of luck or a calculated move remains open to interpretation.