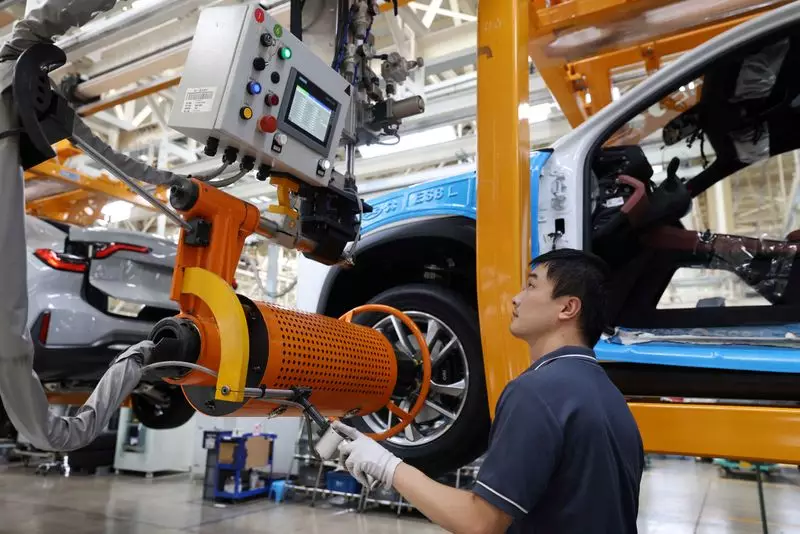

China’s manufacturing sector experienced a decline in August, reaching a six-month low, according to an official factory survey. The official Purchasing Managers’ Index (PMI) dropped to 49.1 in August from 49.4 in July, falling below the 50-mark that separates growth from contraction. This was lower than the median forecast of 49.5 in a Reuters poll. In contrast, the non-manufacturing PMI, including services and construction, accelerated to 50.3 from 50.2.

The world’s second-biggest economy faced challenges at the beginning of the second half of the year, with dismal export figures, prices, and bank lending indicators for July indicating weakened demand. Despite expectations of a recovery following China’s easing of COVID-19 restrictions, the $19 trillion economy has not experienced the anticipated growth. As a result, policymakers are likely to introduce new stimulus plans to shift focus from infrastructure projects to households.

Analysts are urging for a redirection of support towards consumer spending to stimulate economic growth. While there have been positive signs such as retail sales surpassing expectations, the details of how China intends to rejuvenate its consumer market comprising 1.4 billion people remain unclear. The government has expressed intentions to enhance domestic demand by increasing consumer spending, but concrete strategies are yet to be disclosed.

A significant factor impeding consumer spending in China is the struggling property sector over the past three years. With 70% of household wealth tied to real estate, and the sector contributing a quarter of the economy at its peak, consumers have been reluctant to spend. Policies aimed at restoring confidence in the property market have not yielded the desired results, with new home prices falling at their fastest rate in nine years in July. A recent Reuters poll forecasted an 8.5% decline in home prices for 2024, deeper than previously anticipated.

China’s manufacturing slowdown, coupled with challenges in the property sector and consumer spending, poses significant obstacles to the country’s economic recovery. Policymakers will need to reevaluate stimulus plans and leverage various policy tools to achieve the targeted annual growth rate of around 5%. The road to economic revitalization will require comprehensive strategies to address the multifaceted challenges facing China’s economy.