China recently reported data for the month of April that indicated slower growth in retail sales. Retail sales only rose by 2.3% from a year ago, falling short of the 3.8% increase expected. This slower growth in retail sales could be a sign of weakening consumer demand, which is a concerning trend for the economy.

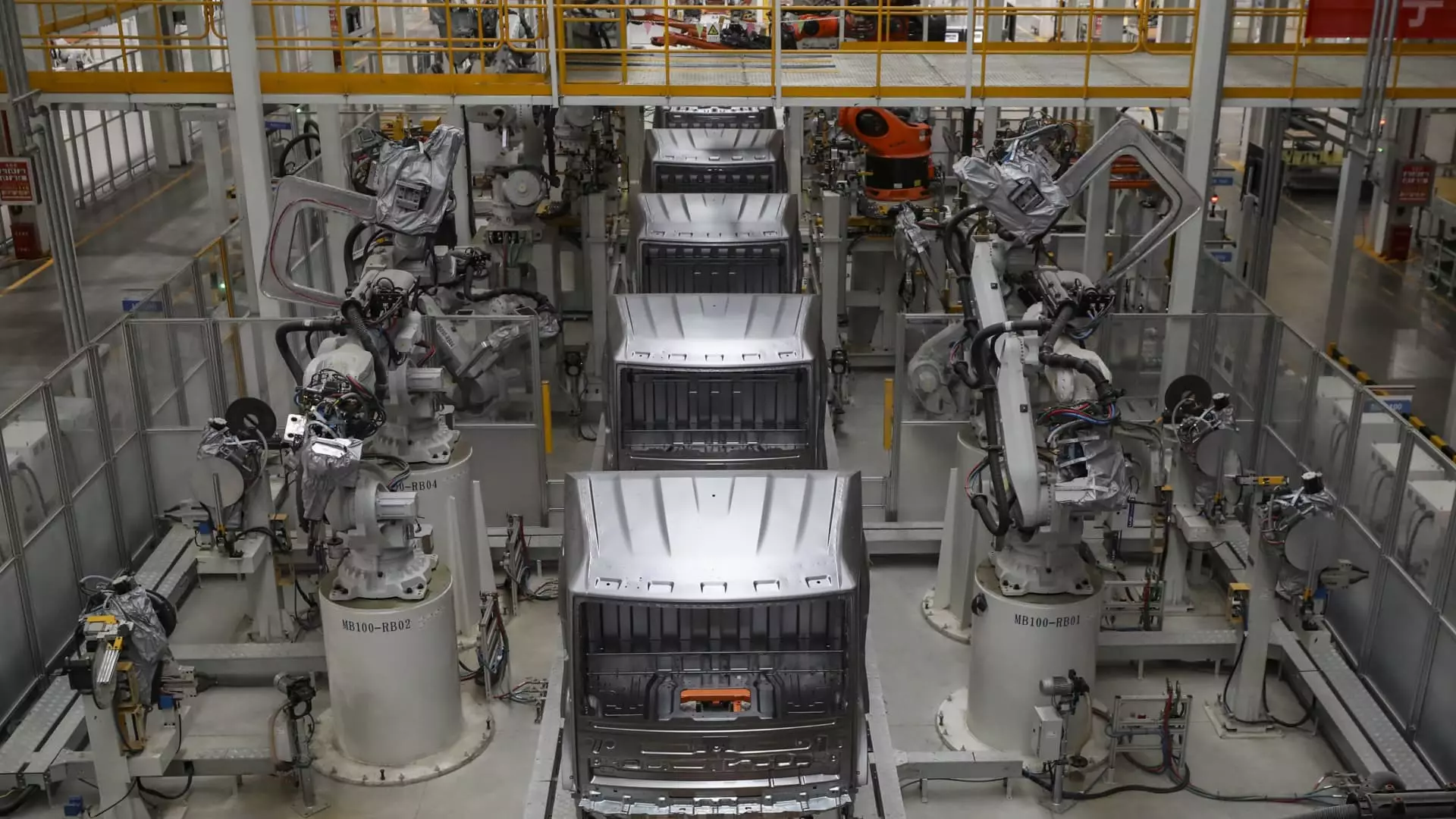

On the other hand, industrial production showed robust growth, with a 6.7% increase from a year ago, surpassing expectations. This strong industrial activity is a positive sign for the economy, as it indicates a healthy manufacturing sector that is driving growth.

However, fixed asset investment only rose by 4.2% for the first four months of the year, lower than the expected increase of 4.6%. This slower growth in fixed asset investment could pose challenges for sustaining economic growth in the long run.

Real estate investment saw a steep decline, with a 9.8% decrease year-on-year for the first four months of 2024. This decline in real estate investment could have broader implications for the economy, as the real estate sector is a key driver of economic growth in China.

Impact on Unemployment Rate

The urban unemployment rate in April was reported at 5%, indicating some challenges in the labor market. High unemployment rates could lead to lower consumer spending, further dampening economic growth in the country.

Outlook for Economic Recovery

While there are some challenges in the Chinese economy, there are also signs of hope. Retail sales showed some growth during a recent holiday period, with sales of home appliances and automobiles increasing. This indicates that consumer spending could pick up in the future, driving economic recovery.

Analysts are cautiously optimistic about the future of the Chinese economy. There are expectations that the issuance of ultra-long bonds could help boost market confidence and support economic growth. However, the real estate sector remains a key area of concern, with ongoing challenges in the market.

China’s economic data for April paints a mixed picture of the economy. While there are signs of slowing growth in retail sales and fixed asset investment, there are also areas of strength, such as robust industrial activity. The coming months will be critical in determining the trajectory of economic recovery in China, with a focus on stimulating consumer demand and addressing challenges in the real estate sector.