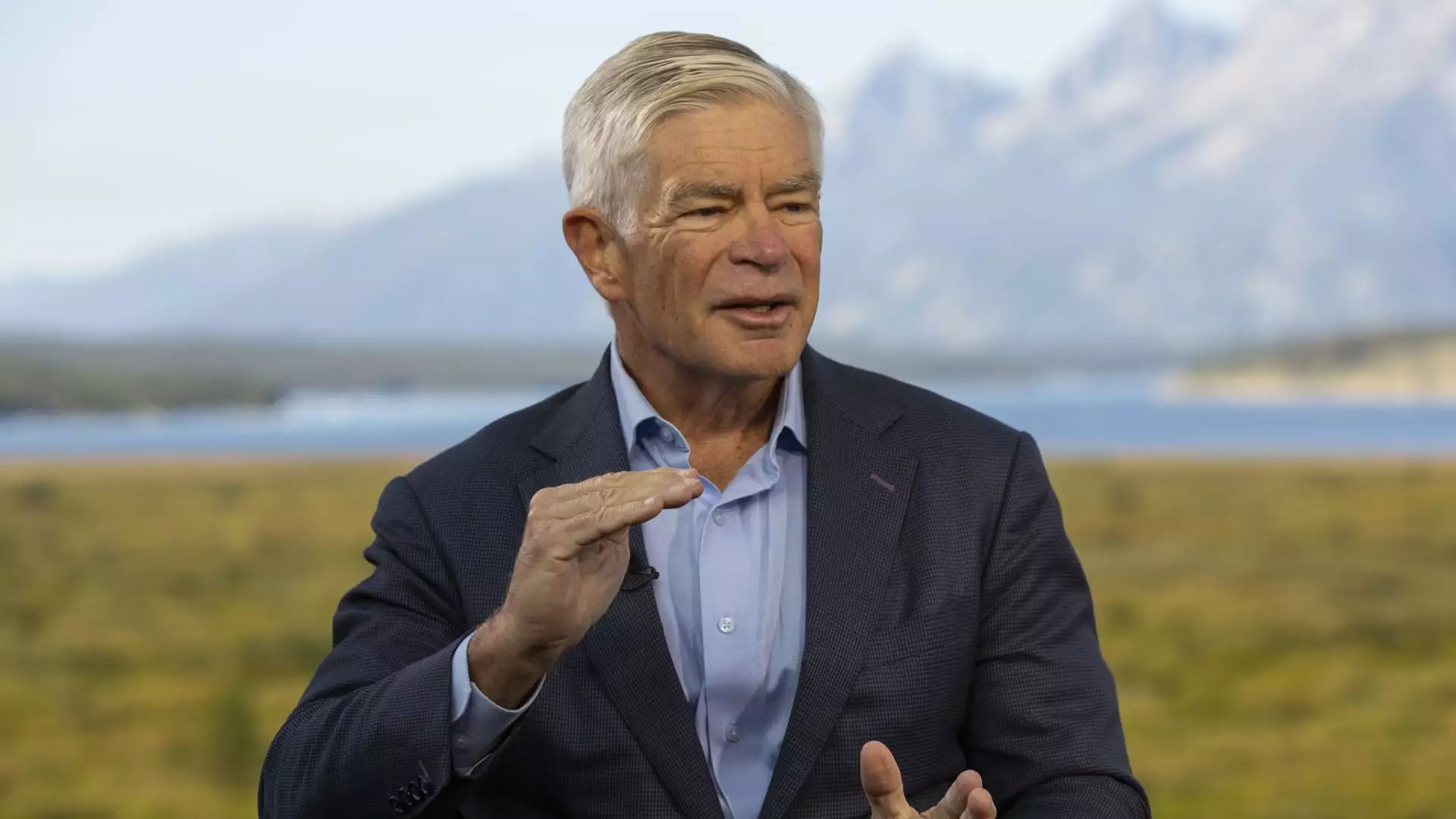

Philadelphia Federal Reserve President Patrick Harker recently provided a strong endorsement for an interest rate cut in September. Speaking during the Fed’s annual retreat in Jackson Hole, Wyoming, Harker expressed a certainty that monetary policy easing is on the horizon. This statement is one of the most direct acknowledgments from a central bank official regarding the potential for a rate cut in the upcoming meetings.

With markets already pricing in a 100% chance of a quarter percentage point cut and a 1-in-4 possibility of a 50 basis point reduction, there is still some uncertainty looming. Harker himself mentioned that he is not firmly in favor of either scenario – 25 or 50 basis points – and indicated the need for more data before making a decision. This uncertainty reflects the complexity and deliberation surrounding monetary policy decisions.

It is crucial to note that Harker emphasized the independence of the Federal Reserve from political influences. As the presidential election approaches, he asserted that decisions will be made based on data and economic indicators rather than external pressures or political considerations. This commitment to technocratic decision-making is essential for maintaining the credibility and effectiveness of the Federal Reserve.

Kansas City Fed President Jeffrey Schmid also weighed in on the future of monetary policy, pointing to the labor market as a key factor. Schmid highlighted the rise in the unemployment rate and the cooling of job indicators as signals that further policy action may be necessary. While acknowledging the progress made in addressing inflationary pressures, he emphasized the need for continued vigilance in managing the labor market dynamics.

Schmid further commented on the resilience of the banking sector in the current high-rate environment. Contrary to concerns about monetary policy being overly restrictive, he expressed confidence in the stability of banks under existing conditions. This assessment underscores the importance of considering the broader economic implications of policy decisions beyond inflation and labor market dynamics.

Future Policy Outlook

Looking ahead, both Harker and Schmid play pivotal roles in shaping future monetary policy decisions. While Harker will not have a voting right until 2026, Schmid is expected to participate in the decision-making process next year. Their perspectives on the need for potential rate cuts and the evolving economic landscape will be instrumental in guiding the Federal Reserve’s actions in the coming months.

The statements from Philadelphia Federal Reserve President Patrick Harker and Kansas City Fed President Jeffrey Schmid highlight the nuanced considerations and complexities involved in determining the appropriate monetary policy stance. With a focus on data-driven decision-making, independence from political influences, and careful assessment of economic indicators, the Federal Reserve is poised to navigate the challenging economic environment effectively.