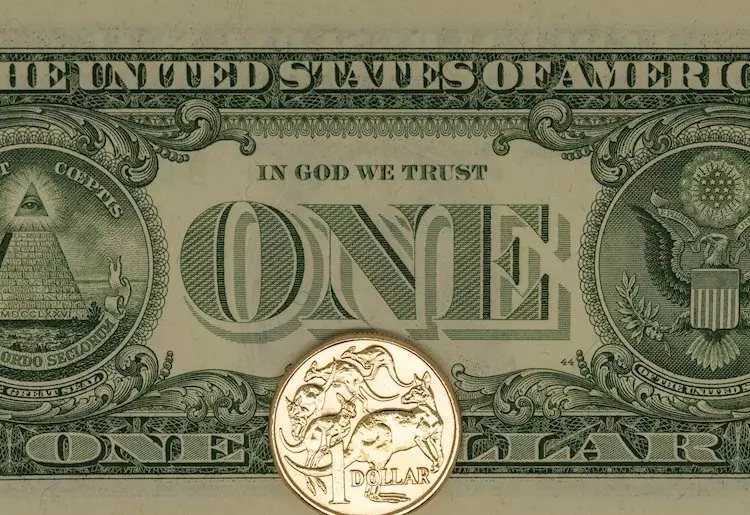

The Australian Dollar (AUD) has recently experienced significant downward pressure against the US Dollar (USD), plummeting to a five-week low below 0.6700. On Wednesday, the AUD/USD traded down by 0.60%, sliding to 0.6662. The breach of the critical support level at 0.6700 signifies broader concerns, especially in light of upcoming employment data expected from the Australian economy. This trend is compounded by factors such as a robust USD, anxieties surrounding the Chinese economy, and declining commodity prices, particularly in metals.

Investor behavior in the foreign exchange market reveals an increasing skepticism towards the Australian economy, particularly as it pertains to its employment landscape. As traders keep a wary eye on any shifts in market sentiment and economic indicators, the AUD remains vulnerable.

Thursday will be pivotal as the markets prepare to digest key employment figures from Australia. Analysts predict that the Employment Change and Participation Rate reports for September may not present a rosy picture. Any disappointing data could further exacerbate the bearish sentiment towards the AUD, potentially prompting market players to adjust their bets on monetary policy by the Reserve Bank of Australia (RBA). Currently, market projections only foresee a modest 0.25% cut in interest rates for 2024. However, if employment figures fail to meet expectations, anticipations of a rate reduction could swell, leading to further downward pressure on the AUD/USD pair.

Adding complexity to the situation is the uncertainty surrounding China’s economic stimulus plans. Discussions from recent press conferences have left investors questioning the extent and impact of any proposed measures. The Chinese market’s unpredictable pulse has substantial implications for the AUD since Australia relies heavily on China as its primary trading partner.

In the context of Australia, commodities—particularly iron ore—play a crucial role in shaping the currency’s fortunes. With China being Australia’s largest trading partner, fluctuations in iron ore prices can have immediate ripple effects on the AUD. If market conditions push iron ore prices higher, demand for the AUD typically surges, bolstering its value. Conversely, a dip in iron ore prices could signal a softening of demand, adversely affecting the currency.

Interest rates set by the RBA further influence the AUD’s trajectory. The central bank aims to maintain an inflation target of 2-3% through interest rate adjustments. A higher interest rate compared to other major economies generally strengthens the AUD, while lower rates diminish its appeal. Hence, the market remains watchful of the RBA’s measures, including any quantitative easing or tightening actions, as they directly relate to the AUD’s performance.

Market sentiment plays an integral role in currency valuations. In periods characterized by “risk-on” behavior, investors gravitate towards higher-yielding currencies like the AUD, buoyed by positive economic indicators or enhanced market confidence. Conversely, during “risk-off” scenarios, the allure of safe-haven assets increases, and currencies like the USD gain strength at the expense of the AUD.

Recent shifts in confidence stemming from domestic and international events have framed the current risk narrative facing the AUD. Consequently, investors and traders must remain vigilant in monitoring developments both locally in Australia and in global markets, especially concerning the health of the Chinese economy.

Currently, the technical outlook for the AUD/USD points to bearish trends, with the Relative Strength Index (RSI) indicating oversold conditions. This suggests that while selling pressures are intense, there may soon be a pause for consolidation before further market movements occur. The Moving Average Convergence Divergence (MACD) underscores the prevailing bearish stance, reinforcing the notion of sustained downward momentum.

Key support levels to watch include 0.6660, 0.6650, and 0.6630. At the same time, resistance levels hovering at 0.6700, 0.6730, and 0.6750 may become critical battlegrounds in the near future. Acknowledging these technical indicators is essential for market participants seeking timely entry and exit points.

As the Australian Dollar grapples with multiple headwinds, including weak employment prospects, fluctuating commodity prices, and overarching economic uncertainties, the outlook remains cautious. The looming employment figures and the ongoing assessment of China’s economic strategies will significantly shape market direction in the coming days. Investors will need to remain agile, equipped to adapt to fast-changing conditions that can impact both the AUD and broader market sentiment. As traders navigate complex global economic currents, the Australian Dollar’s fate is closely tied to regional and international economic dynamics.