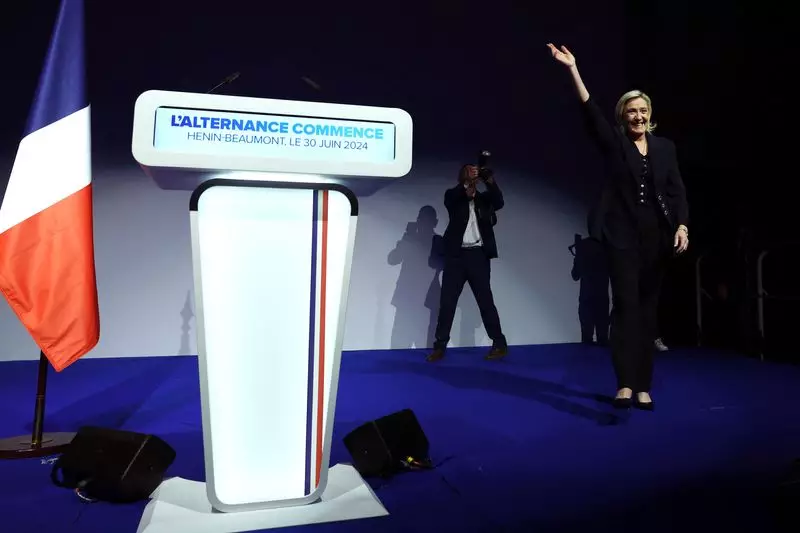

The far-right National Rally (RN) party’s victory in the first round of France’s parliamentary elections has stirred up a mix of reactions among investors and market analysts. The euro experienced a slight gain, reflecting a sense of cautious optimism in early Asia-Pacific trading. However, the final outcome remains uncertain, with days of negotiations and horsetrading ahead before the upcoming run-off election.

Market analysts are closely monitoring the unfolding political landscape in France and its potential impact on the economy. Concerns have been raised over the possible increase in government spending promised by both far-right and left-wing parties, which could further strain France’s delicate financial situation. Uncertainties surrounding the seat projection and potential alliances are adding to the overall apprehension in the markets.

The shock decision by President Emmanuel Macron to call for a snap election has sent ripples through European markets. The prospect of a far-right or left-wing victory has left investors on edge, as the outcome of the parliamentary elections could have far-reaching implications for the region. The high level of uncertainty is likely to keep volatility levels elevated in the days leading up to the final results.

Market experts have expressed a mix of sentiments regarding the current political situation in France. While some view the outcome of the first round as relatively positive compared to initial fears, others remain cautious about the potential implications of a hung parliament or a stalemated situation. The need for clarity in the seat distribution and the formation of a stable government is crucial for restoring market confidence.

As attention shifts to the upcoming run-off election on July 7, the focus is on whether the second round will provide a clearer picture of the political landscape in France. Analysts are keen to see if there will be a decisive outcome or if the uncertainty will linger, influencing market dynamics in the coming days. The potential for further alliances and strategic moves by different parties adds another layer of complexity to the situation.

The fluctuation in the euro and French assets is expected to continue as investors navigate through the political uncertainties. The outcome of the parliamentary elections, the formation of a new government, and the overall stability of the country will play a significant role in shaping market trends in the short to medium term. Analysts are closely monitoring the developments to assess the potential risks and opportunities for investors.

The first round of France’s parliamentary elections has set the stage for a period of heightened uncertainty and speculation in the markets. The outcome of the run-off election and the subsequent formation of a government will be critical in determining the future course of the economy. Investors are advised to remain cautious and vigilant as they navigate through this period of political turbulence.