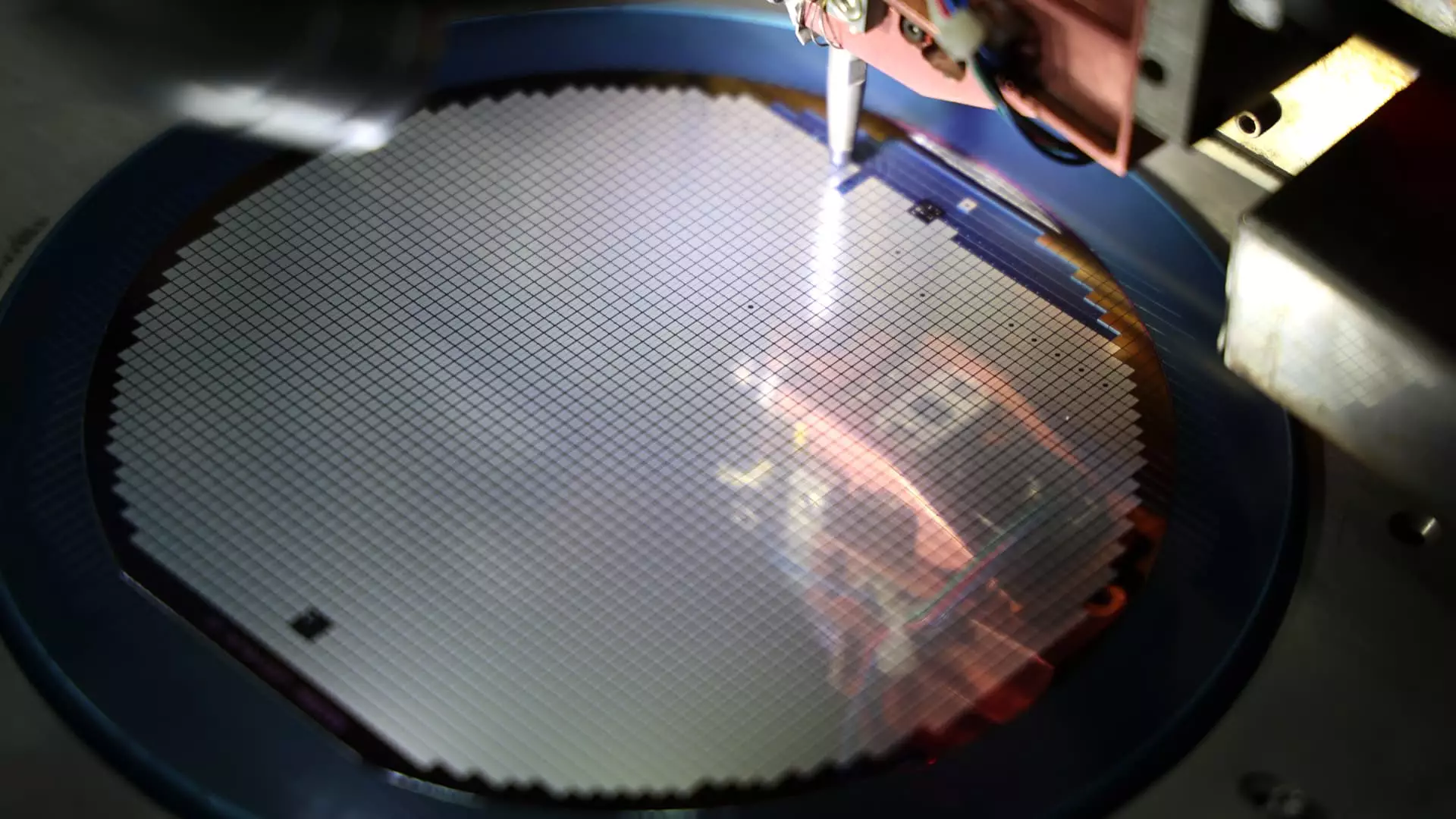

Recent reports from Bank of America analysts have revealed a significant increase in the China revenue of four of the world’s largest semiconductor equipment manufacturers. Companies such as ASML, Lam Research, KLA Corp, and Applied Materials have seen their China revenue more than double since late 2022. This surge in revenue has been attributed to China’s accelerated purchase of semiconductor manufacturing equipment following tighter export restrictions imposed by the U.S. in October 2022.

The analysis by BofA highlighted the growing importance of the semiconductor industry in the ongoing trade tensions between the U.S. and China. With China aiming to develop its own semiconductor manufacturing capability, the demand for advanced equipment from top manufacturers has soared. This trend has been reflected in the significant increase in the share of China revenue for these companies, from 17% to 41% in just a few quarters.

The U.S. decision to impose strict export controls on advanced semiconductors and related manufacturing equipment to China has further escalated the trade tensions between the two countries. This move has prompted China to focus on enhancing its tech self-sufficiency and reducing reliance on external suppliers. The recent discussions within the Biden administration about imposing broader restrictions on semiconductor equipment exports to China have created uncertainty in the industry.

Despite the challenges and uncertainties surrounding the semiconductor industry, the VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, has maintained its gains for the year so far. However, the recent fall in the ETF indicates the volatility and sensitivity of the market to geopolitical developments. As the industry continues to evolve, companies will need to navigate the changing landscape of international trade policies and market dynamics.

The semiconductor equipment manufacturers are facing a complex and challenging environment influenced by geopolitical tensions and regulatory changes. The increased revenue from China underscores the country’s efforts to enhance its semiconductor capabilities, while also highlighting the vulnerability of companies to changing trade dynamics. As the industry adapts to these shifts, strategic partnerships, technological innovation, and regulatory compliance will be key factors in shaping the future of semiconductor manufacturing both in China and globally.