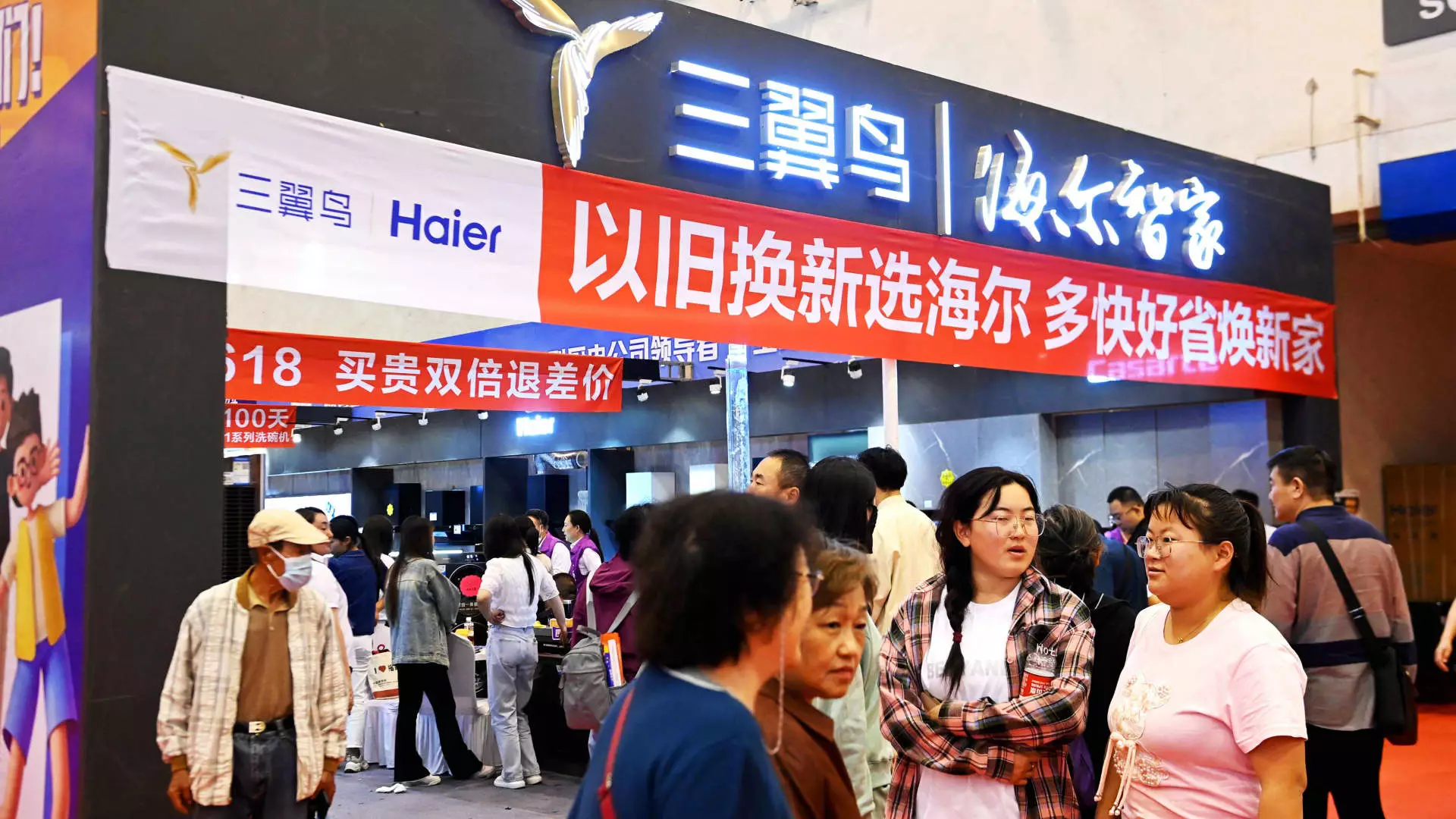

In an effort to revitalize its economy through heightened consumer spending, the Chinese government initiated a trade-in program aimed at encouraging the replacement of older consumer goods. However, as the implementation progresses, businesses report that the anticipated impact remains largely unrealized. This article delves into the nuances of China’s trade-in strategy and examines its effectiveness in encouraging widespread consumer participation, as well as the broader implications for the economy.

In July, China allocated a staggering 300 billion yuan (approximately $41.5 billion) in special government bonds designated for stimulating consumer spending through trade-ins and equipment upgrades. Deeply embedded within this initiative is a strategy to enhance the consumption of larger-ticket items like automobiles and home appliances, while also facilitating the modernization of essential infrastructure, including elevators. Local governments are granted the responsibility of deploying these ultra-long government bonds to subsidize purchase costs, creating a framework intended to bolster consumer confidence and spending.

The design of the program is both ambitious and intricate, as it requires consumers to possess a used item to trade in while also having the financial means to invest upfront. This dual requirement raises questions about the policy’s immediate effectiveness in an economy characterized by cautious consumer behavior. The intricacies of this approach have sparked skepticism among experts and industry leaders who argue that substantive benefits may be slow to materialize.

Despite the government’s bold intentions, a range of businesses have expressed concerns regarding the tangible outcomes of this trade-in initiative. Jens Eskelund, president of the EU Chamber of Commerce in China, highlighted a lack of reported successes from companies capitalizing on these new policies. According to Eskelund, the focus must now shift to the execution of these policies, to yield visible and measurable results that can stir consumer enthusiasm.

Furthermore, a report from the chamber estimates that the budgeted subsidy amounts to only about $29.50 per capita, prompting doubts about the sufficiency of these funds to significantly alter domestic consumption patterns. Analysts from UBS Investment Bank have echoed this sentiment, suggesting that the new policy may only support an increase of approximately 0.3% in retail sales during 2023.

Adding to the complexity of this situation, China’s retail sales figures are experiencing sluggish growth, with only a 2.7% increase in July following a disappointing 2% uptick in June—the slowest rates recorded since the COVID-19 pandemic. Although sales of new energy vehicles have surged by nearly 37% within the same timeframe, the overall decline in passenger car sales underscores the mixed effects of the trade-in program on diverse sectors.

The Challenges of Implementation: Insights from the Industry

The rollout of the trade-in policy has faced significant challenges, particularly in terms of clarity and local execution. Prominent companies in the elevator manufacturing sector have indicated that specific orders attributed to the new program have yet to materialize, suggesting that the initiative is still in its infancy. These concerns raise a critical point: while the government has promoted its intentions to stimulate consumption, the actual implementation and allocation of funds are paramount.

Sally Loh, president of Otis China, noted that while there is clear interest from local governments in ensuring effective deployment of their allocated funds, the specifics surrounding how much of the budget is being directed toward relevant industries remain unclear. Major elevator manufacturers like Kone have also reported declines in revenue, reflecting the challenges posed by the property market slump and indicating that without a clear framework for execution, the potential benefits of the trade-in scheme could remain unfulfilled.

Although immediate results may be sparse, industry leaders suggest that governments can harness these policies to pave the way for a sustainable secondhand goods market. For instance, companies like ATRenew are beginning to witness growth in trade-in activity for certain product categories, driven largely by e-commerce participation. This indicates that while the trade-in program may not yield rapid results in all sectors, it may contribute to a broader cultural shift toward sustainable consumption practices over time.

China’s trade-in program illustrates a bold governmental strategy that aims to stimulate consumer spending amid economic uncertainty. However, the mixed feedback from various businesses and the slow pace of implementation highlight significant hurdles that need to be cleared for the program to achieve its desired outcomes. As the Chinese economy continues to grapple with these issues, ongoing evaluations of consumer behavior and response will prove critical in determining both the long-term viability of the trade-in initiative and its ultimate success in invigorating domestic consumption.