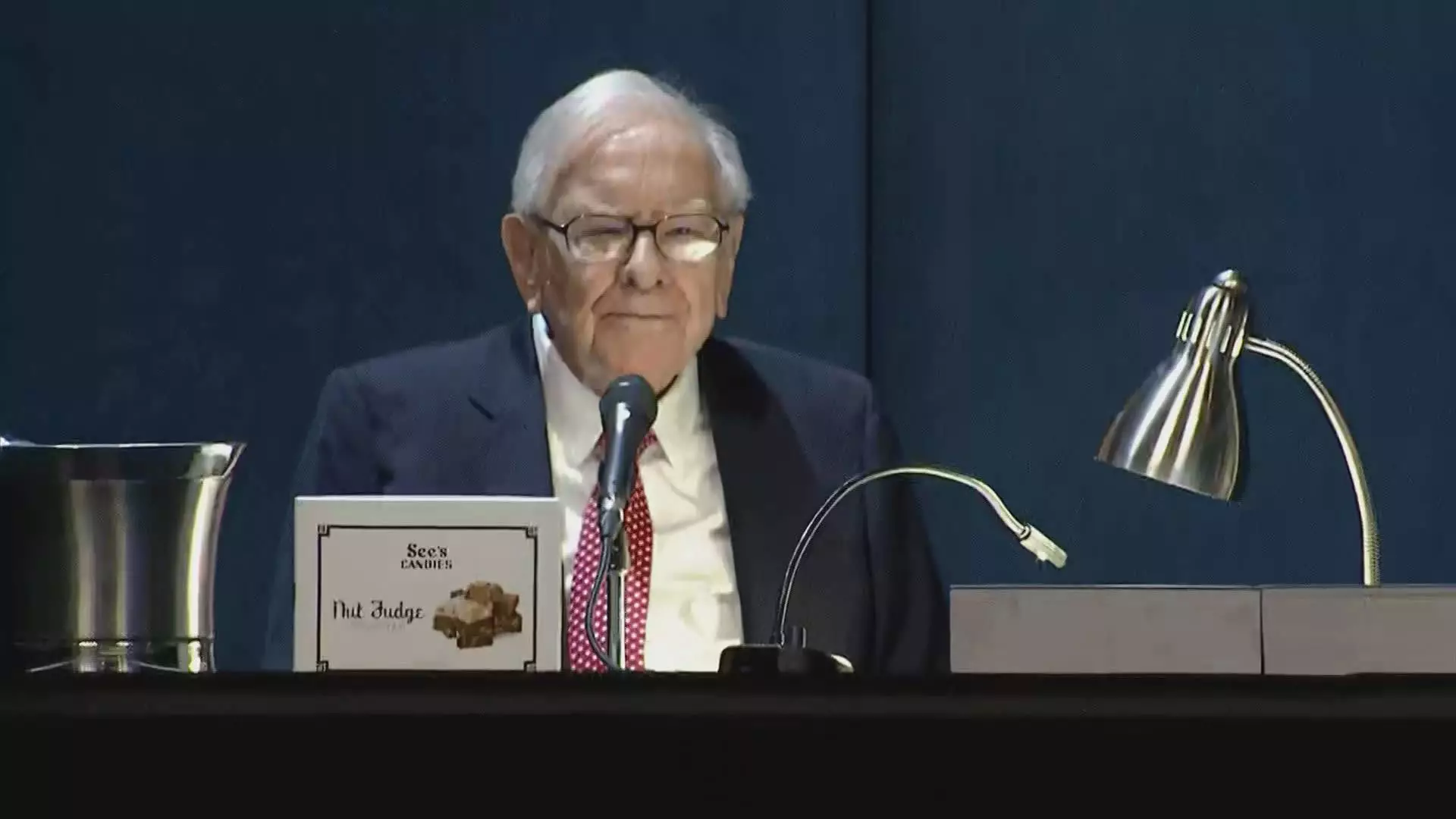

In recent months, Warren Buffett, the CEO of Berkshire Hathaway, has taken a notable step back from one of his most high-profile investments: Apple Inc. For the fourth consecutive quarter, Buffett has reduced his stake in the tech behemoth, which had previously been heralded as the cornerstone of Berkshire’s equity portfolio. As of the end of September, Berkshire Hathaway’s holdings in Apple were valued at approximately $69.9 billion, indicating a considerable sale of about 300 million shares and reflecting a staggering 67.2% decrease compared to the previous year.

The trajectory of Buffett’s decisions raises important questions: What is driving these consistent divestments, and what implications do they hold for Berkshire Hathaway’s future direction? The firm’s initial foray into Apple in 2016 marked a significant shift in Buffett’s historical avoidance of technology investments, showing a newfound appreciation for the brand’s loyal customer base and innovative ecosystem. However, the ensuing sales suggest a reevaluation of this landmark decision.

Despite initial enthusiasm for Apple, the reasons behind Buffett’s recent moves appear multi-faceted. Analysts speculate that high valuations might be prompting the Oracle of Omaha to rethink his investment strategy. After all, Berkshire’s exposure to Apple once represented a hefty portion of its entire equity portfolio, amounting to nearly half at one point. Thus, a deliberate reduction in concentration risk seems prudent from a portfolio management standpoint.

Additionally, Buffett hinted at potential tax considerations during a Berkshire annual meeting, suggesting that impending tax hikes on capital gains might inspire an urgency to sell. This raises an intriguing prospect—could the scale of these divestments signify concerns beyond mere tax efficiency? The dramatic reductions in stake provoke speculation of broader strategic shifts rather than a simple reaction to appraisal concerns or tax strategies.

As Berkshire’s Apple holdings diminish, the organization’s cash reserves have swelled to unprecedented levels, peaking at $325.2 billion during the third quarter. This accumulation of cash amid a selling spree could signify a strategic pivot or a cautious approach to investments in an uncertain economic climate. Strikingly, Berkshire completely halted buybacks during the same quarter, suggesting a shift away from self-investment in favor of stock liquidations, a move that analysts are closely watching.

The overall performance of Apple stock, which has risen by 16% this year but still falls short of the S&P 500’s 20% gain, further complicates the narrative. This perceived underperformance compared to the broader market may serve as an additional catalyst for Buffett’s exit strategy, pushing him to reassess whether continuing with Apple aligns with the conglomerate’s long-term goals.

Buffett’s methodical reduction of his Apple holdings indicates a profound evolution in his investment philosophy, marked by caution and critical reflection on past decisions. As the legendary investor continues to navigate the complexities of a rapidly changing market landscape, his actions serve as both a mirror and a harbinger of the broader dynamics influencing corporate America. For Berkshire Hathaway and its stakeholders, the coming months will likely reveal the true ramifications of this strategic retreat from Apple and the implications for future investments.