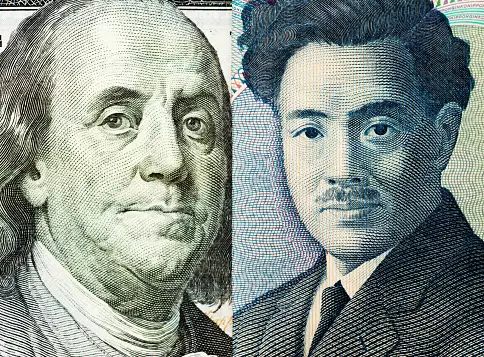

The yen’s recent depreciation against the US dollar has raised concern among Japanese officials, leading to a potential intervention by the Bank of Japan. This weakening trend was last observed in late April when the yen traded above 160 yen per USD. The volatility in the currency market has prompted warnings against excessive fluctuations, signaling the possibility of further interventions to stabilize the yen’s value.

Despite the Bank of Japan’s efforts to strengthen the yen in late April, the market quickly negated the effects of the intervention within a span of two months. This demonstrates a strong upward trend driven by the interest rate differentials between Japan and the US. Technical analysis of the USD/JPY chart highlights an upward trajectory in June, indicating a potential breach of the April peak and the upper boundary of the blue channel.

The yen’s weakness not only impacts the currency market but also has implications for the Bank of Japan’s monetary policy. A sustained depreciation of the yen can increase imported inflation, putting pressure on the central bank to adjust its ultra-loose policy. The minutes from the recent central bank meeting reveal discussions about reducing bond purchases and raising rates, reflecting the challenges posed by the yen’s volatility.

For forex traders, the fluctuations in the USD/JPY rate present opportunities for profitable trades. The technical analysis suggests potential support at the 158.20 level, which could act as a springboard for further upside movement in the currency pair. With over 50 forex markets available 24 hours a day, traders can leverage low commissions, deep liquidity, and competitive spreads to capitalize on the yen’s weakness against the US dollar.

It is important to note that the opinions expressed in this article represent the views of companies operating under the FXOpen brand and should not be construed as financial advice. Traders are advised to exercise caution and conduct their own research before making any trading decisions based on the information provided.