Gold prices have been on a positive trajectory for the past few days, mainly due to the weaker US dollar. The recent US Nonfarm Payrolls data indicated a slower job growth rate, leading to speculations of potential rate cuts by the Federal Reserve. This anticipation of an easing cycle has made gold a more attractive option for investors, especially foreign buyers.

The ongoing political tensions in the Middle East also play a significant role in boosting the safe-haven appeal of gold. Despite the acceptance of a cease-fire plan by Hamas, Israel’s rejection and continued attacks have kept the uncertainty levels high. This instability in the region is likely to support the gold price in the near term.

Central Banks’ Influence on Gold

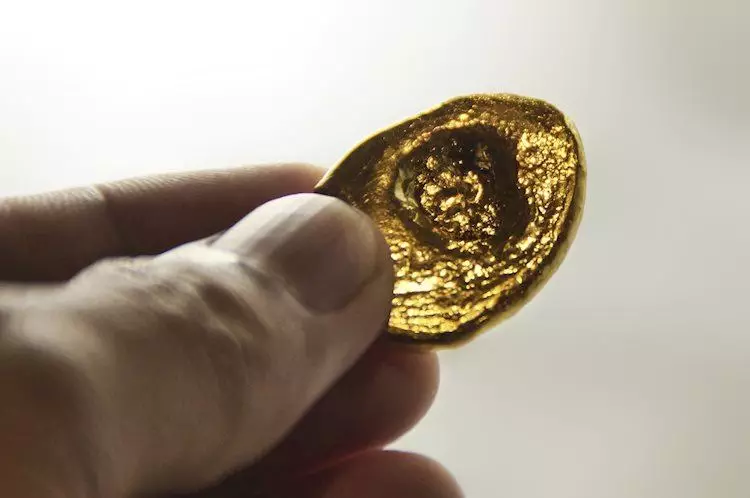

Central banks play a crucial role in influencing the price of gold. With the recent surge in gold purchases by central banks, the precious metal continues to be seen as a hedge against inflation and depreciating currencies. The diversification of reserves by central banks, especially from emerging economies like China, India, and Turkey, has contributed to the increasing demand for gold.

The market sentiment towards gold remains constructive, with the precious metal trading above the key 100-day Exponential Moving Average (EMA). The expectation of an interest rate cut by the Fed has pushed gold prices higher, with potential upside targets around the $2,400 psychological mark and an all-time high near $2,432. On the downside, support levels are identified at $2,300 and $2,275, serving as critical levels to watch for a potential reversal.

Various factors contribute to the movement of gold prices on a day-to-day basis. Geopolitical instability, fears of a recession, and fluctuations in the US dollar and US Treasuries all impact the price of gold. Additionally, the inverse correlation between gold and risk assets, such as stocks, plays a role in determining the gold price. The asset’s status as a safe-haven investment during turbulent times also adds to its appeal.

The future trajectory of gold prices will largely depend on how the US dollar behaves. As a yield-less asset, gold tends to rise in value with lower interest rates and geopolitical uncertainties. The inverse relationship between gold and the US dollar implies that a weaker dollar will likely push gold prices higher, while a stronger dollar may keep the precious metal’s price in check.

The interplay between the US dollar, geopolitical tensions, central bank actions, and market sentiments all contribute to the fluctuation in gold prices. As investors continue to monitor these factors closely, the price of gold is expected to remain volatile in the near term.