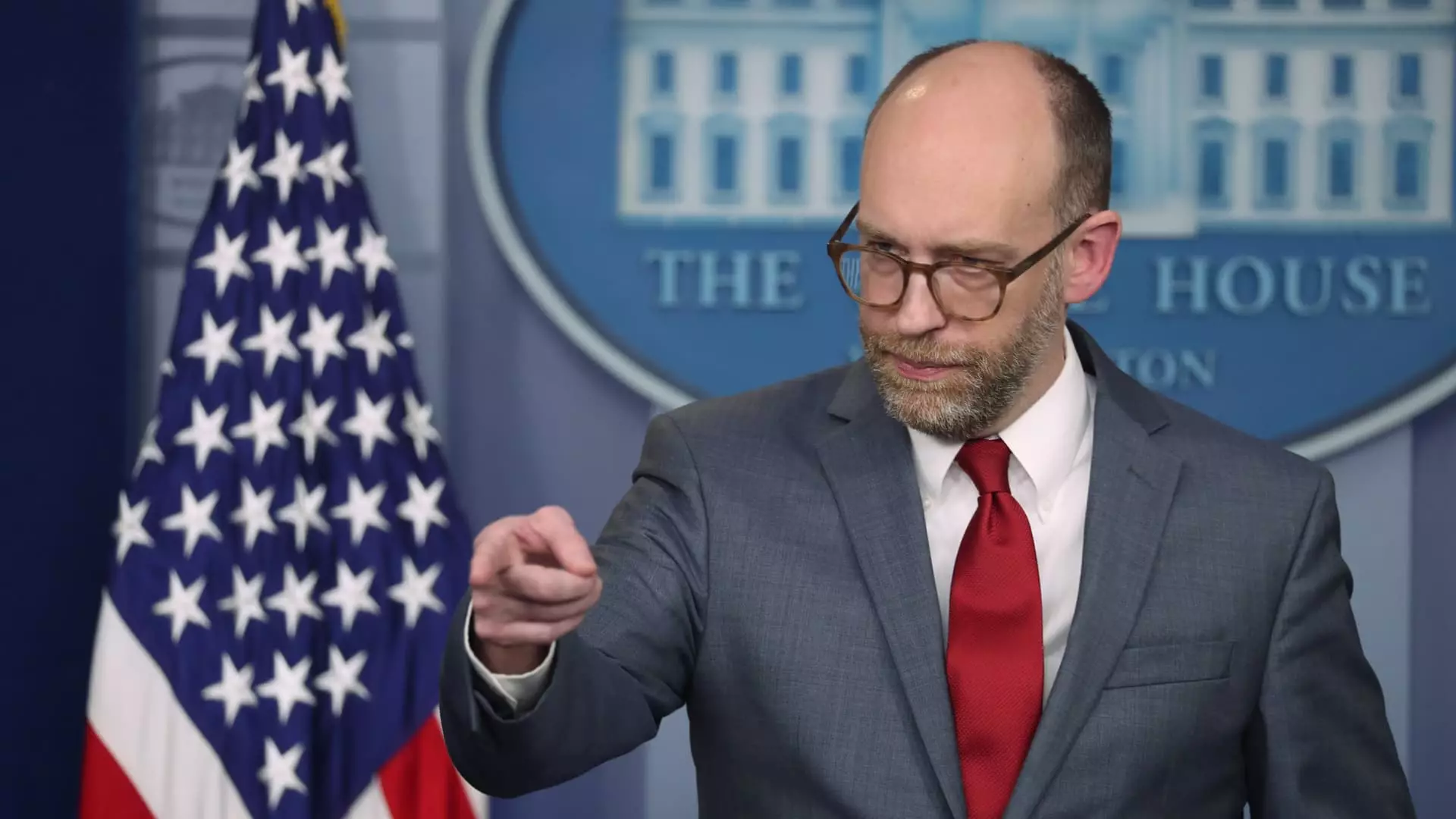

The recent turmoil surrounding the Consumer Financial Protection Bureau (CFPB) raises grave concerns about its future operations and the potential impacts on American consumers. With the new acting director Russell Vought’s directive to halt nearly all regulatory activities and the unexpected intrusion of personnel associated with Elon Musk’s DOGE group, the CFPB appears to be facing a severe existential crisis. This situation is indicative of broader implications for consumer protection in the financial sector, especially given the agency’s history and purpose.

The memo released by Adam Martinez, CFPB’s Chief Operating Officer, ordered employees to transition to remote work owing to the closure of the agency’s Washington, D.C. headquarters until at least February 14. This abrupt shift reflects the agency’s precarious state. On the one hand, it hints at an organizational paralysis triggered by political maneuvers, while on the other hand, it showcases the agency’s ongoing commitment to function even under adverse conditions. Employees transitioned to remote work not just for comfort but also to maintain some semblance of productivity during this unprecedented freeze on regulations.

The ramifications of Vought’s directive are profound. By suspending the supervision of financial firms, which is a core function of the CFPB, Vought signals an alarming shift in governance towards less oversight in an industry notorious for malpractices. With the memo, the agency’s ability to safeguard consumers against potential predatory practices is put on hold, raising questions about whether it will serve its primary mission to prevent exploitation in financial transactions.

Musk’s involvement—through accessing CFPB data and publicly dismissing the agency—highlights the delicate balance between political pressure and regulatory independence. With Musk previously calling for the dismantling of the CFPB, his active engagement within the agency further complicates its operations. The presence of DOGE operatives within the CFPB and their unfettered access to sensitive employee data raises severe ethical dilemmas and potential conflicts of interest. The implications of such access could lead to retaliation or a chilling effect on whistleblower protections that are vital for exposing wrongdoings in the financial sector.

The political motivations behind these developments become clear when considering Project 2025, a plan designed to significantly reshape federal structures. Vought’s immediate halt of funding to the CFPB fits into a broader scheme to diminish regulatory bodies viewed as bureaucratic hurdles by some political factions. This stance raises not just urgent questions about the CFPB’s stability but also about the ethical implications of wielding governance as a tool for political gain.

Given the CFPB’s essential role established after the 2008 financial crisis, the agency’s eroded capacity to enact consistent oversight could result in dire consequences for average Americans. With plans that could have curtailed fees and removed harmful medical debt from credit reports, the effects of Vought’s restructuring plan could lead to financial setbacks for millions. The likelihood of mass layoffs—predicted by various insiders—further compounds this concern.

Financial consumers may face a landscape where protection against unfair practices is significantly weakened. The CFPB has historically been the frontline defender against exploitative actions from financial institutions, yet the agency’s capabilities are now under threat. If the CFPB is unable to fulfill its mandate due to budget cuts and staff reductions, it could open the floodgates for rampant consumer abuses akin to those seen before the Great Recession.

The developments within the CFPB highlight a stark contrast between regulatory efficacy and political agendas. The potential dismantling of core consumer protections threatens to plunge millions back into vulnerabilities that the agency was created to eliminate. It is crucial for stakeholders, including the public and lawmakers, to advocate for the agency’s stability and independence during this turbulent period.

As the situation unfolds, the CFPB must strive to reclaim its footing amid the looming shadows of political maneuvers. The foundation of consumer financial rights hangs in the balance, requiring vigilant oversight and passionate advocacy to ensure that the rights of Americans are not sacrificed at the altar of political expediency. Ultimately, the trajectory of the CFPB will have lasting repercussions on the financial security and dignity of countless individuals across the nation.