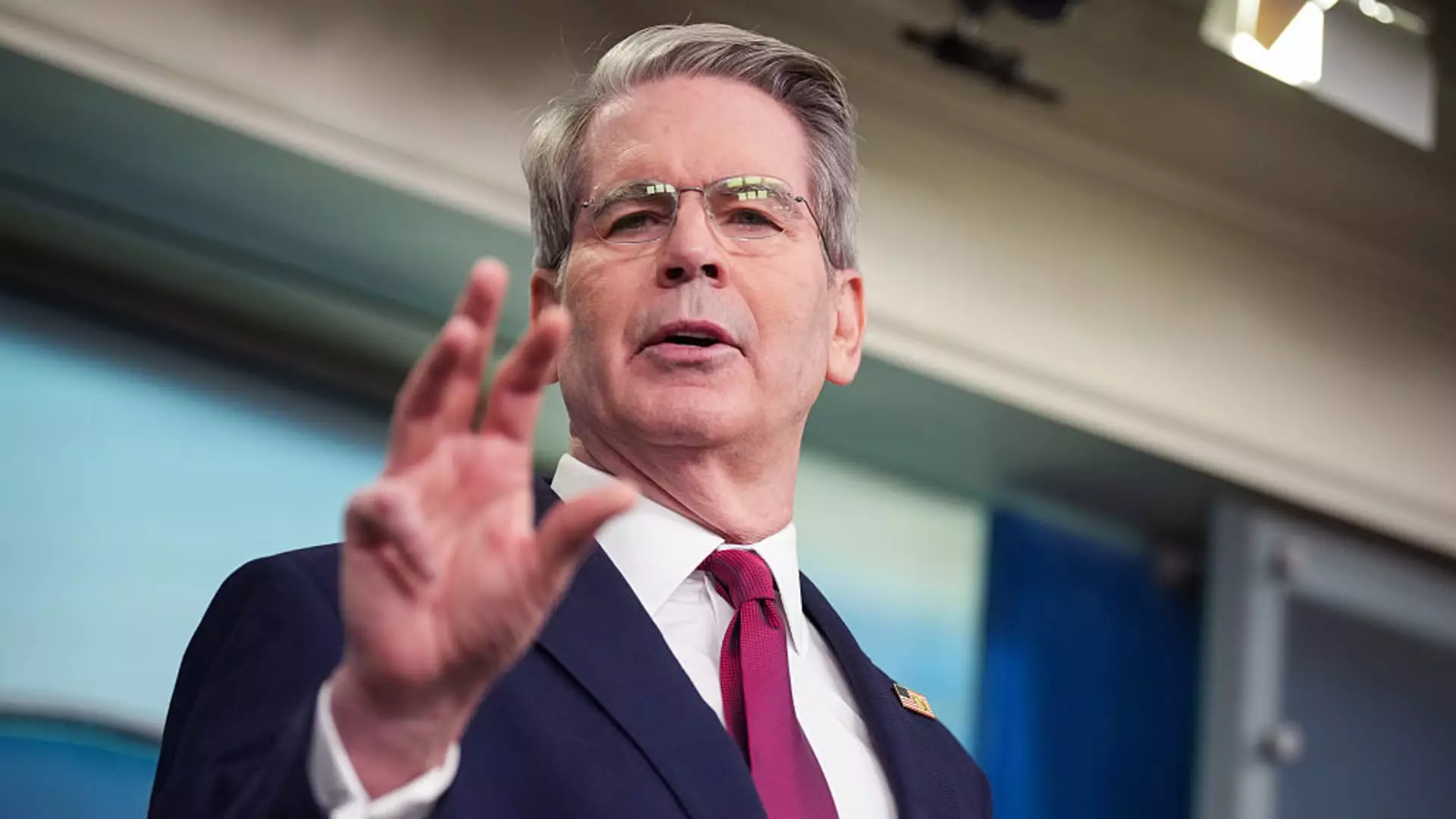

In the face of unprecedented market volatility, characterized by tumultuous sell-offs and geopolitical tensions, individual investors have showcased a remarkable resolve, contrary to the frantic reactions exhibited by institutional players. Treasury Secretary Scott Bessent’s recent remarks highlighted a striking reality: while institutional investors scavenged for safety during recent financial fluctuations, individual investors remained largely steadfast, demonstrating an unwavering confidence in the economic framework architected under President Donald Trump’s tariff policies. This differentiation tells us much about the psychological disposition of retail versus institutional investors, illustrating how often institutional wisdom can falter amid panic.

Bessent noted that 97% of individual investors had refrained from trading over a significant 100-day period, an insight derived from a report by Vanguard, one of the largest money management firms in the country. This statistic is not merely a reflection of individual restraint; it encapsulates a sense of trust in the macroeconomic direction and policy blueprint established by the current administration. There’s an essential narrative here: retail investors possess a patience that belies the anxiety displayed by their institutional counterparts, who opted to liquidate positions and hedge against further losses.

Market Reaction to Tariffs and Economic Strains

The financial landscape post-tariff announcements has been far from stable. The dramatic fluctuations observed in the S&P 500, which briefly descended into bear territory, serve as a litmus test for investor sentiment. While Bessent’s remarks suggest confidence among retail investors, the broader implications of Trump’s trade policies loom ominously over the economic horizon. The tariffs, heralded as a pillar of the administration’s strategy, have incited fears regarding their capacity to inflate consumer prices and potentially catalyze a recession.

Prominent economists such as Torsten Slok have warned of a looming summer recession as tangible impacts of these tariffs begin to resonate in everyday life—specifically, as consumers witness increasing trade-related shortages. Such forecasts prompt a re-evaluation of the broader economic implications of unilateral trade policies. The question remains: how long can individual investors maintain their trust under such conditions? Their willingness to hold onto investments despite adverse innovations speaks volumes about their long-term outlook, but can it withstand the pressure of economic reality?

The Global Implications of the Trade War

The ongoing trade tensions and tariff implementations do not merely affect the national landscape; they possess the potential to shape global markets and economic perceptions. Industry experts, including Ken Griffin of Citadel, underscore a critical concern: Trump’s trade policies could tarnish the allure of U.S. Treasury bonds, once viewed as a bastion of safety. Such a shift would undermine the foundational perceptions globally regarding U.S. economic stability, which could deter foreign investments and reshuffle the risk landscape.

The intertwining of investor behavior and policy impacts uncovers a much deeper narrative than simple market trends. Individual investors, holding their ground while institutional funds retreat, suggest a fundamental gap in trust and understanding of the economic implications of these tariffs. In a climate where information often drives decision-making, the divergent paths taken by these two investor classes raise pivotal questions about market health and sentiment’s resilience against policy challenges.

This observed trend begs for deeper awareness—beyond mere statistics—of how trade policies affect not only broader economic frameworks but individual investor mindsets. Perhaps in a world rife with volatility, it is the steadfast individual investor that truly embodies the unpredictability of market dynamics, serving as a counterbalance to the often reactionary nature of institutional trading.